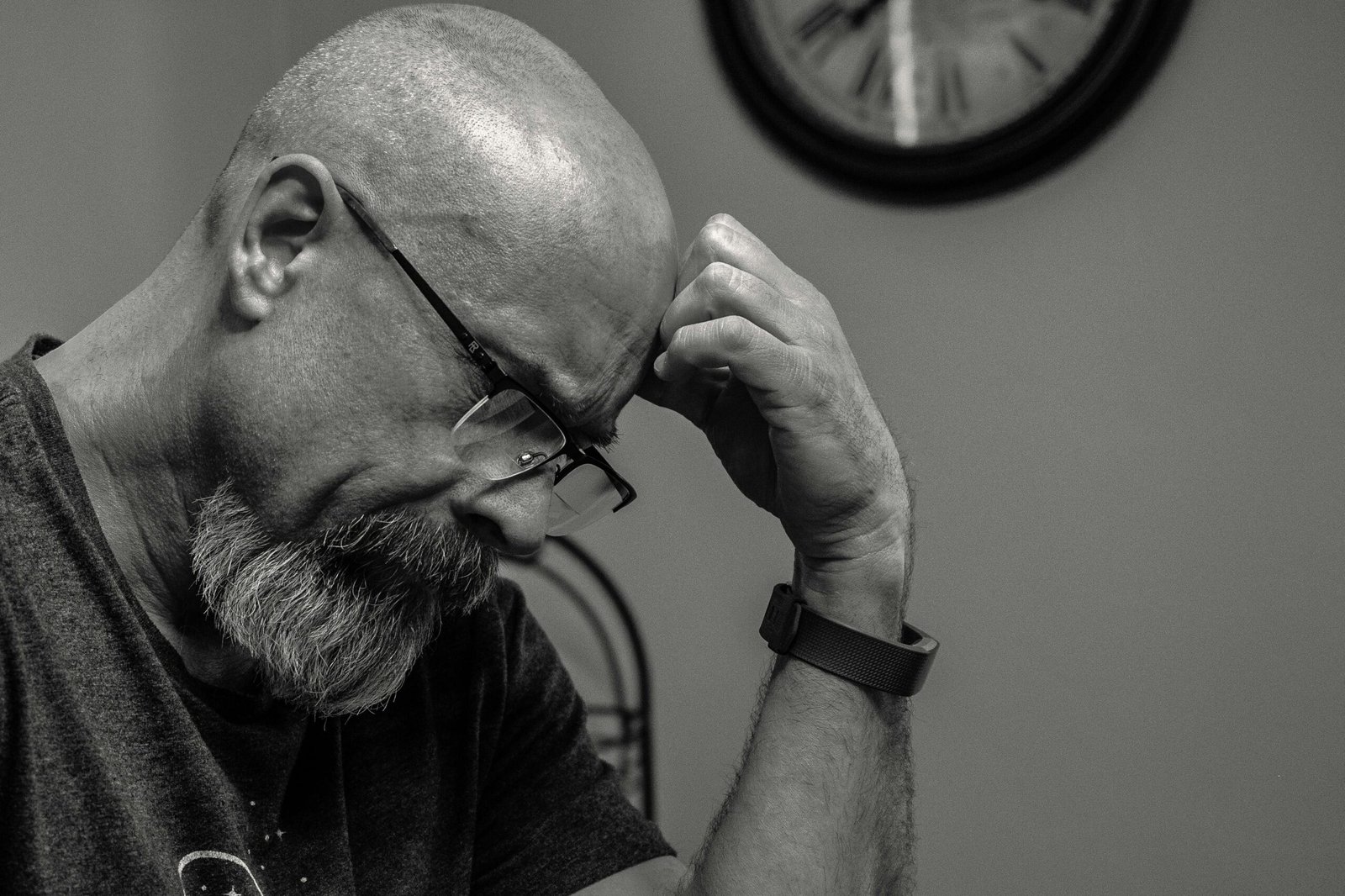

Debt can feel overwhelming, like a constant weight on your shoulders that affects everything from your sleep to your ability to plan for the future.

Whether it’s credit card bills or student loans, unpaid medical expenses or the car, unchecked debt can quickly spiral out of control. Business professional and financial speaker Alex Kleyner has spoken extensively about the importance of addressing financial issues early.

Especially when it comes to medical debt, which often goes ignored until it causes long term damage. The good news though is that you can regain control and there are some steps that you can take to stop debt from taking over your life and start building more financial stability into your future.

Face those numbers head on.

The first step to manage that debt is to acknowledge it. Many people avoid looking at their bank statements or credit card balances out of fear or shame, but burying your head in the sand will only make the problem worse. List all of your debts out, including medical bills, student loans, credit card balances or personal loans. Once you’ve got it all listed, you’ll be able to know exactly how much you owe and to whom, which gives you the clarity you need to take action.

Create a budget and stick with it.

Once you know where you stand, it’s time to create a realistic budget. A budget isn’t a punishment, it’s a plan that helps you to take back control. Identify your essential expenses like housing, food and transport, and then determine how much you can allocate to paying off your debt every month. Prioritize those high interest debts first. The debt’s close to default or collections and anything that you could negotiate.

Explored debt reduction strategies

There is never a one size fits all solution to having debt, but you can choose a method that best fits your situation. Snowballing helps you to pay off your smallest debts first to build momentum. Avalanching focuses on the debt with the highest interest rate to save money long term. You can also take out a loan for debt consolidation and can buy multiple debts into one with a lower interest rate. You could also reach out to your creditors, especially for medical debt, to ask about reduced balances on monthly payment plans.

Avoid taking on more.

As you work to pay off what you owe, it’s critical not to add more debt to the pile. Avoid credit cards unless absolutely necessary, and if spending is a challenge, using a cash only system or prepaid cards helps you to stay within your budget. Building good habits now prevents you from falling into the same cycle in the future.

Ask for help.

You don’t have to do any of this alone. Financial advisors, credit counsellors and non profit organisations can help you to create a personalized debt management plan. If medical debt is part of the issue, there are patient advocacy groups out there and hospital programs designed to assist.