Table of Contents

- Introduction

- Understanding Small Business Resilience

- Economic Challenges and Opportunities

- Leveraging Technology for Growth

- Financial Strategies for Stability

- Building Strong Community Networks

- Disaster Preparedness and Recovery

- Case Studies of Resilient Small Businesses

- Conclusion

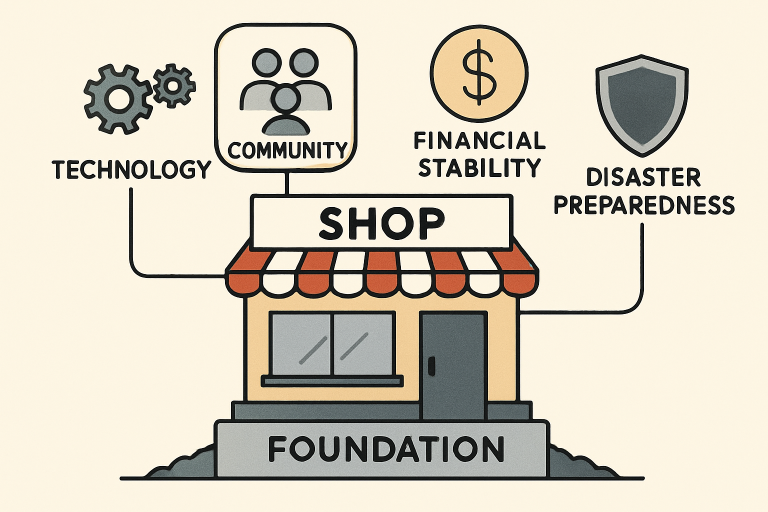

Small businesses are the foundation of many economies, contributing innovation, employment, and community stability. Yet, in today’s climate of rapid technological advancement and frequent economic disruption, it is more important than ever for entrepreneurs to focus on resilience. This involves not just adapting to change but also thriving in the face of uncertainty, whether from technological shifts, market fluctuations, or unexpected disasters. As small business owners look to secure their future, seeking resources and insurance for small business owners is a crucial step toward building a stable foundation.

Navigating risks and capitalizing on opportunities demands practical approaches and forward-thinking strategies. With a solid commitment to continual improvement and leveraging community support, small businesses have the tools to overcome challenges and achieve sustainable growth.

Understanding Small Business Resilience

For small businesses, resilience is defined by the ability to adapt, endure, and grow through various trials. This means more than simply withstanding difficult periods. It reflects a capacity to innovate and regroup in the face of adversity, maintaining effective operations despite challenges beyond their control. The ability to respond quickly to change has become increasingly important, given the accelerated pace of technological progress and global disruptions that affect supply, consumer behavior, and business regulation.

Resilient businesses are distinguished by owners who anticipate potential obstacles and plan accordingly, embrace learning, and foster a culture that motivates their teams during both smooth and turbulent times. By building a strong operational foundation, small businesses ensure their continuity and preserve stakeholder trust.

Economic Challenges and Opportunities

Small business owners today face a fluctuating and often unpredictable economic environment. Recent research highlights a notable paradox: while 49 percent of entrepreneurs anticipate a weaker national economy, nearly two-thirds remain optimistic about their local revenue growth. This contrast illustrates the impact of internal innovation and steady operational management, even as broader economic trends present hurdles. Businesses that can control their internal dynamics are often better positioned to pivot quickly, exploit emerging opportunities, and minimize the negative impacts of external forces.

By focusing on controllable factors such as customer service, product development, and employee well-being, small businesses can not only protect but also enhance their competitive standing, even amid economic headwinds.

Leveraging Technology for Growth

Adapting to digital transformation is now a priority for ambitious small businesses. Automation, cloud computing, and, more recently, artificial intelligence are being integrated rapidly, offering greater efficiency and access to new markets. In fact, 91 percent of small and medium-sized enterprises using AI in their operations have seen direct improvements in revenue, with some reporting cost reductions of up to 30 percent.

Investing in digital tools, whether to streamline internal processes, improve customer engagement, or enhance data analysis, empowers small businesses to compete with larger counterparts. These advances help owners allocate resources effectively and make data-driven decisions that promote steady business growth. Many small businesses credit technology adoption as a key driver for their resilience and expansion in challenging times.

Financial Strategies for Stability

Sound financial management is the backbone of resilience. To build staying power, businesses should routinely analyze their cash flow, ensuring that incoming revenues are sufficient to meet both foreseeable and unexpected expenses. Setting aside emergency funds provides a cushion against slow sales months and unforeseen crises, such as equipment breakdowns or urgent repairs. Additionally, small business owners should diversify their revenue streams. This may mean introducing new services, exploring online sales, or investing in complementary products.

Diversification minimizes dependence on any single income source and reduces vulnerability to sudden market shifts. Review financial statements regularly and work with an accountant or financial advisor to identify areas for improved efficiency and growth.

Building Strong Community Networks

Community engagement is a powerful asset for small business survival. Cultivating relationships with other local businesses, participating in community initiatives, and joining business networks or associations bolster both reputation and practical support. During times of crisis, these networks can be instrumental in providing referrals, facilitating collaborations, and offering advice or shared resources. Engaging with the community also nurtures customer loyalty and fosters a greater sense of belonging, both of which are invaluable for business longevity.

Disaster Preparedness and Recovery

Unexpected disruptions from natural disasters to cyberattacks can devastate unprepared small businesses. The U.S. Small Business Administration emphasizes that comprehensive disaster planning significantly reduces recovery times and lessens economic impacts. This includes documenting an action plan, regularly updating employee contact lists, backing up digital files, and ensuring proper insurance coverage is in place. Regular training and rehearsal of the plan equips teams to act quickly and effectively in the event of a real disaster.

Case Studies of Resilient Small Businesses

Business resilience in action shows up in a variety of models. For instance, some businesses have adapted to major supply chain disruptions by adopting flexible sourcing strategies or shifting quickly to e-commerce platforms. Others prioritize staff development and wellness programs, which contribute not only to retention but also to rapid adaptation in evolving circumstances. Across the board, resilient businesses emphasize regular customer engagement and transparent communication, supporting stronger relationships and enduring brand loyalty.

- Readiness and willingness to pivot when markets or regulations change

- Ongoing investment in personnel through skills development and training

- Consistent, positive customer relationships built on reliability and communication

These qualities form the foundation for long-term sustainability and repeated success, as observed by business experts and highlighted in

Conclusion

The ever-evolving economy challenges small businesses to stay nimble, informed, and connected. Achieving resilience is not about avoiding risks entirely but developing strategies that enable businesses to recover, adapt, and find new paths to growth. By embracing technological innovation, practicing sound financial management, connecting meaningfully with communities, and preparing for the unexpected, small businesses can create a future defined by stability and success. These steps ensure that, even amid uncertainty, small businesses remain a vibrant and essential part of the economy.

Photo by Andrea Piacquadio: